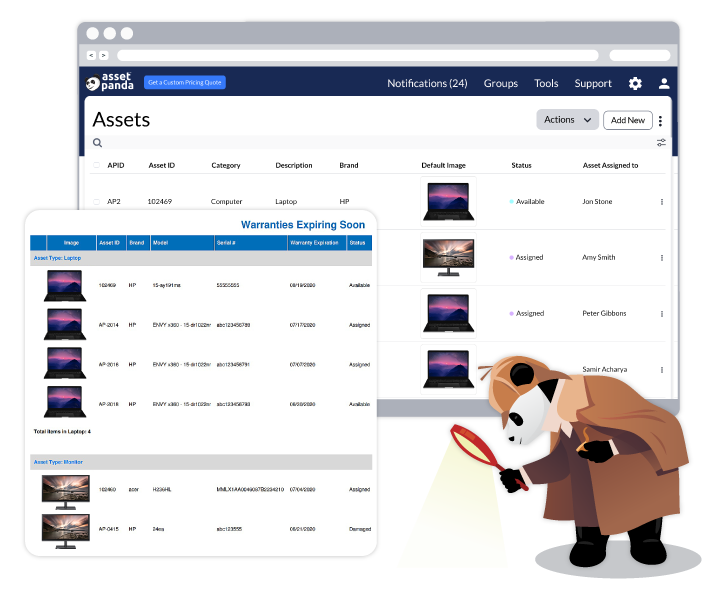

Fixed Asset Tracking

Reduce frustration by keeping track of who has what and where it's supposed to be

Gain freedom from spreadsheets with a centralized platform that grants easy access to everyone in your organization. Use custom fields to track data points like mileage, cost, or anything you can imagine.

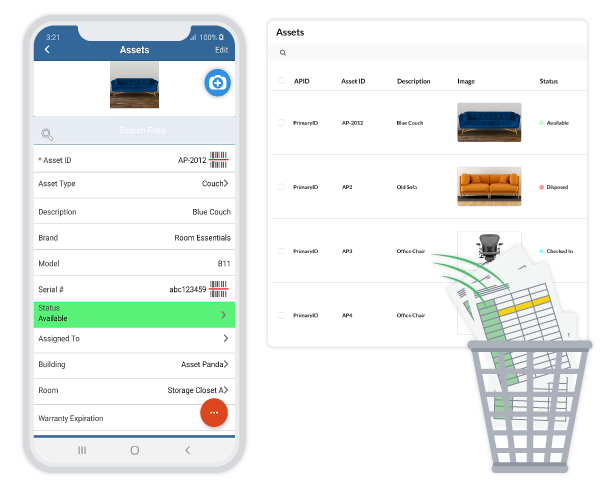

Anytime, anywhere access

iOS and Android apps let you perform actions and lookups right where you are

Keep remote and on-premise workers on the same page with the devices your company already owns. Manage asset data, request repairs, perform audits and more from the palm of your hand. Plus, provide access to an unlimited number of users without paying for costly extra seats.

Thompson Law Eliminates Two Months of Downtime

“Before, we had to wait on licenses...we just weren’t on the same page. There would be times where people would be sitting at their desk for a day or two waiting for licenses...or they waited half the day to get their computer going.”

Zach Owen

IT Manager

Eliminating Guesswork for Car Wash Services of the Southeast

“Technicians in the field can transfer tools or equipment with ease and we can track all of those actions anytime, from anywhere, so that nothing is lost or misplaced.”

Brenda Bradley

Controller

Full Data Flexibility for EagleView

“Asset Panda has given us the greatest flexibility thus far -- allowing our teams to have the ability to create overarching asset types as we break down our flight rig hardware into many specific points with their respective subset systems.”

Patrick Stefano

Aerial Camera System Production

Tumblr Got "Asset Management That Doesn't Suck"

“Simple, straight forward asset management that doesn't suck. Plus, Pandas! Who doesn't love Pandas, am I right??”

Jessica Pell

IT Systems Engineer

Fully featured asset tracking for any need

Mobile app

Stay as mobile as your assets with the Android or iOS devices you already own.

Custom workflow actions

Enhance your workflows for faster and easier asset updates and management.

Custom fields

Put data in your language for easier adoption and unclutter your records by showcasing only what's necessary.

Asset history

Enhanced accountability and forecasting for every asset with full audit trails.

Custom notifications

Keep everyone informed automatically for improved efficiency and planning.

Role-based access

Enhanced data security and simple onboarding for any job function.

Record-level attachments

Faster asset identification, easier access to vital asset data, and better employee self-service.

Built-in barcode scanner

Eliminate the need for expensive and bulky barcode scanning equipment.

Further Resources

Learn more from an Asset Panda expert

Get a FREE consultation with an asset tracking expert to find out how you can transform your asset tracking