5 Spreadsheet Errors That Put Your Government Audit at Risk (And How to Fix Them)

Blog

Table of Contents

Take Control of Your Assets

A personalized demo is just one click away.

It's two weeks before the auditors arrive. You're staring down a file named Fixed_Assets_Master_v5_FINAL_USE_THIS_ONE.xlsx, and a cold dread sets in. Is this really the same spreadsheet that the finance team is using? And who added that mysterious new tab? Through no fault of your own, you’re facing some textbook spreadsheet risks for government audits, and you’ve got just a handful of weeks to make the situation right.

Chaos at auditing time isn’t a personal failing—it’s a tool failing. Your trusty spreadsheet is the biggest unseen liability in your audit prep. It’s not about you or your team's skills; it’s that you're using the wrong tool for a mission-critical job. The small mistakes you fix every day are symptoms of a systemic problem that auditors are trained to find.

The very nature of spreadsheets—manual entry, lack of history, and poor controls—makes them fundamentally unsuitable for the high-stakes world of public sector asset management. Moving to a dedicated system isn't just about convenience; it's a foundational step towards guaranteed compliance and stress-free audits. That’s why migrating away from spreadsheets is a pillar of GASB-compliant asset management.

Need another nudge to move to a solution that’s not only easier for you, but also more accurate? Here are five common spreadsheet errors that put your government audit at risk.

Error 1: The “Fat Finger” Fiasco (Data Entry Errors)

It begins with an innocent typo. Perhaps a purchase price entered as $15,000 instead of $1,500, or the wrong acquisition date is recorded. It only takes one errant keystroke to threaten the accuracy of your spreadsheet, but it could take a lot more than that to fix the repercussions that follow.

A single data entry error regarding an asset's acquisition price or date may be tiny, but it’s one of the biggest spreadsheet risks for government audits there is. It throws off all subsequent depreciation calculations, leading to materially inaccurate financial statements that auditors will flag immediately. But this nightmare scenario could have been avoided.

The solution: a dedicated system that uses locked fields, data validation, and automated calculations to eliminate human error from the equation. These basic features that come with asset tracking software mean errors don’t make it into the data in the first place. Leave the data entry to a program so you can focus on more high-level asset management tasks.

Error 2: The Version Control Void (Multiple “Final” Copies)

Does the file titled Assets-Master-Final-FINAL.xlsx really deserve to sound so confident? For all you know, the finance department has one version, public works has another, and IT has a third. Nobody knows which one is the real source of truth. And you guessed it, this is a huge problem for your upcoming government audit.

Auditors require a single, authoritative source of truth. Multiple versions demonstrate a lack of internal controls and make reconciliation impossible, leading to a potential audit finding. It doesn’t matter if one of your spreadsheets contains the correct information if there are other versions that contradict it. And thanks to the broad potential of data-entry errors, it’s far more likely that each spreadsheet version contains a mixture of true and false data.

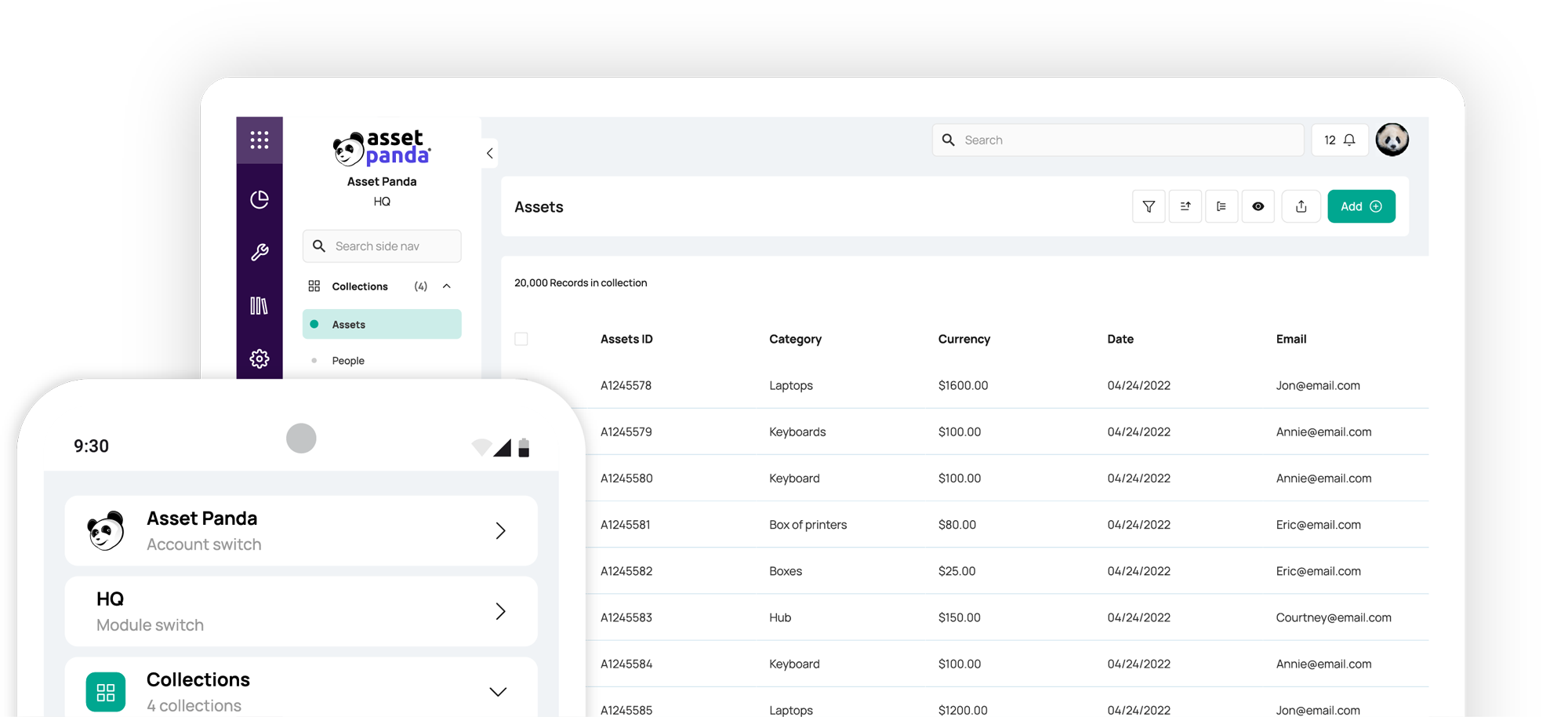

Meanwhile, conducting asset management on a cloud-based platform ensures everyone is working from the same real-time data. There is only one version: the current one.

Error 3: The Phantom Audit Trail (No Change History)

An asset is deleted from the list, or a value is changed. Who did it? When? And most importantly, why? When you’ve got no audit trail, you’re unlikely to find these answers in your spreadsheet version history.

While it’s true that spreadsheet software like Excel offers a rudimentary version history function, the feature leaves much to be desired. It can’t be viewed on all types of devices. It only records changes from users who are logged in; otherwise, it offers only the black box of a “Guest Contributor.” The version history function is only available if you use Excel in tandem with OneDrive, Google Drive, or Dropbox—further complicating your process. And worst of all, a spreadsheet's total change history can be erased at any time.

As a county sheriff's office discovered when they needed to secure their chain of custody, a lack of version control is a critical failure. Compliance requires a complete, unalterable history for every asset. The lack of a verifiable audit trail is a major red flag that suggests data could be manipulated. And beyond these issues at audit time, missing change history can cause headaches on a daily basis. You don’t have time to track down your collaborators every time you need to confirm the truth of the values on your spreadsheet.

Avoid spreadsheet risks for government audits with a solution that acts as a centralized hub for your data. Every single action—from creation to disposal, from a status change to a maintenance update—is automatically logged with a user, date, and time stamp in a dedicated system.

Error 4: The Broken Formula Blunder

Picture this: a user accidentally deletes a formula in a single cell, or a complex VLOOKUP breaks, returning #N/A values that go unnoticed. Broken calculations quietly corrupt your entire dataset. This undermines the integrity of your financial reporting and proves to auditors that the data cannot be trusted.

This is one of the most basic reasons why spreadsheets fail for asset management.

Your formulas are useful as long as they’re still functioning, but the more you rely on them, the more fragile they become. When a load-bearing equation becomes inaccurate for whatever reason, the fix means going on an abrupt scavenger hunt through the tabs of your dataset looking for the problem, causing a headache for your whole team. If you have a lot of training in Excel, you can use built-in tools to help you trace through the formulas and eventually solve the problem. But should you really have to spend the time and resources to train your team to become Excel pros as well as asset managers?

A better option is to leave the computing to the computer. In an asset tracking software solution, all calculations—especially depreciation—are handled by the software's backend. They are standardized, consistent, and cannot be accidentally broken by a user.

Error 5: The Security Sieve (Zero Access Control)

A spreadsheet can be emailed, saved to a thumb drive, or altered by anyone with access to the file. This portability is convenient right up until audit time comes around. There's no way to restrict users to only see or edit assets relevant to their department. If just anyone is able to make changes to the spreadsheet, that means just anyone is able to insert an error, too.

It’s understandable why some organizations see a strength where government auditors see a weakness. Asset management is a job that requires your solution to be as flexible as you are and to go where you go. But an unsecured spreadsheet isn’t the solution. This lack of granular security demonstrates a failure to protect sensitive financial data. Auditors will see it as a significant internal control weakness.

What you need is a modern system that allows for role-based permissions, ensuring users can only see and act upon the assets they are authorized to manage. Best of all, this doesn’t mean you have to give up your flexibility. Since you can access your cloud-based asset management software from any device simply by logging in with the correct credentials, it’s just as portable as a spreadsheet—minus the security risks.

The Real Solution: Moving From a Spreadsheet to a System of Record

If you've experienced any of these common spreadsheet risks for government audits, it's not because you aren’t a good asset manager. None of these issues has anything to do with you or your team’s skills, and in fact, some of them can be exacerbated by people due to good intentions. They’re simply the result of using tools that don’t fit the job.

A centralized asset management platform is specifically designed to solve all five of these problems by default. A dedicated system uses locked fields, data validation, and automated calculations to make fat finger flubs a thing of the past. It maintains one central master version complete with robust version control. It handles the formulas your depreciation calculations rely on automatically. And it manages user roles and permissions.

Moving to a dedicated system isn't just about convenience; it's a foundational step towards guaranteed compliance and stress-free audits. Watch your audit week woes disappear when you ditch that unwieldy spreadsheet for Asset Panda's reliable, centralized system. See how our government asset management platform can help you calm the chaos and create a unified database of assets in your personalized demo.

For even more tips to stay audit-ready, read The Ultimate Guide to GASB-Compliant Asset Management.

Take Control of Your Assets

A personalized demo is just one click away.

Additional resources to help you stay audit-ready

Learn more from a solution specialist

Schedule a demo to find out how you can transform your workflows with Asset Panda Pro

Contact our team at (888) 928-6112