How to Manage Depreciation in Asset Panda Pro

Blog

Table of Contents

Take Control of Your Assets

A personalized demo is just one click away.

Effective asset tracking isn’t just about knowing where your items are and what condition they’re in—it's also about understanding their true value with clear depreciation tracking. Accurately calculating fixed asset depreciation ensures clear financial reporting, better decision-making, and smarter budgeting.

To ensure a seamless depreciation tracking process for our clients, Asset Panda offers automated depreciation calculations using 5 common methods. In this guide, we’ll walk you through the steps to easily set up, automate, and report on your fixed asset depreciation in Asset Panda Pro.

1. Setting Up Depreciation in Asset Panda Pro

The first step to setting up depreciation within your Asset Panda Pro account is to activate it at the Collections level. This means you’ll navigate to:

Settings → Collections → Manage → Toggle “Depreciation” On

Once you’ve enabled depreciation within your desired Collection(s), you’ll see depreciation fields such as depreciation type, cost, salvage value, and useful life automatically appear. From there, you can manually populate these fields directly in your account or bulk import the data using a spreadsheet. This flexibility makes it easy for any organization to tailor their depreciation tracking to fit their existing processes, all without the need for custom coding or complex setup.

2. Choosing Your Depreciation Method

Once depreciation has been turned on, the next step is to go into your Collection(s) and select which depreciation method you’d like to use for each asset. Asset Panda supports five industry-standard depreciation types, giving finance and operations teams exactly what they need for accurate and compliant records.

- Straight-Line Depreciation: Evenly spreads cost over the asset’s useful life.

- Declining Balance: Applies a fixed percentage each year, accelerating early-life depreciation.

- Sum of the Years’ Digits: Another accelerated method for assets that lose value quickly.

- Units of Production: Depreciation based on usage or output, perfect for equipment and machinery.

- Double Declining Balance: A faster version of the declining balance method.

To select your desired depreciation method, simply click on an asset and scroll down to the Depreciation Type field. When you choose which depreciation type you’d like to use, Asset Panda dynamically adjusts which input fields appear. For example, choosing “Units of Production” adds estimated units and units produced fields, making data entry intuitive and precise.

Once these details are entered, Asset Panda automatically calculates depreciation over time, showing the current month’s expense, booked value, last depreciation expense, and total accumulated depreciation.

3. Filtering, Reporting, and Custom Views

Beyond streamlining your depreciation calculations, Asset Panda Pro makes it simple to slice and report on your data. For example, you can filter by certain fields like:

- Depreciation type (e.g., Straight Line)

- Book value thresholds (e.g., assets under $20,000)

Users can also create custom depreciation views to streamline recurring reporting by only showing relevant fields such as ID, purchase date, current book value, depreciation expense, and accumulated depreciation. This can be done by simply hiding the fields you don’t need in a report and saving your view to easily access the same data in the future.

Automated and Historical Depreciation Reports

While Asset Panda Pro makes it easy to save data views and manually export reports in various formats (PDF, Excel, and CSV), automations help you take efficiency and time savings one step further.

For example, you can schedule a monthly depreciation report to be generated and delivered to your accounting team on the first Monday of each month. By doing so, Asset Panda will automatically calculate your assets’ depreciation expense and then send that report directly to your team’s inbox.

For reports you may not have automated yet, or simply missed a few months of reviewing, you can seamlessly run historical depreciation reports for any date range (e.g., the past 6 months) to instantly calculate your total and monthly depreciation. This feature is invaluable for closing periods, audits, and compliance reviews.

Why Depreciation Tracking Matters

With these features, Asset Panda Pro turns what used to be a tedious accounting chore into an automated, transparent, and insightful process.

By tracking depreciation inside the same system that manages asset data, companies gain:

- A complete lifecycle view from acquisition to disposal.

- Accurate financial insight with consistent, up-to-date depreciation values.

- Reduced manual work thanks to automations and report scheduling.

- Audit-ready documentation backed by clear, historical records.

Start Streamlining Depreciation with Asset Panda Pro

Asset Panda isn’t a simple asset tracker; it’s a no-code platform for full asset lifecycle management, including financial intelligence. Whether you’re managing vehicles, IT hardware, or heavy equipment, you can easily configure, automate, and analyze depreciation your way — without ever leaving the platform.

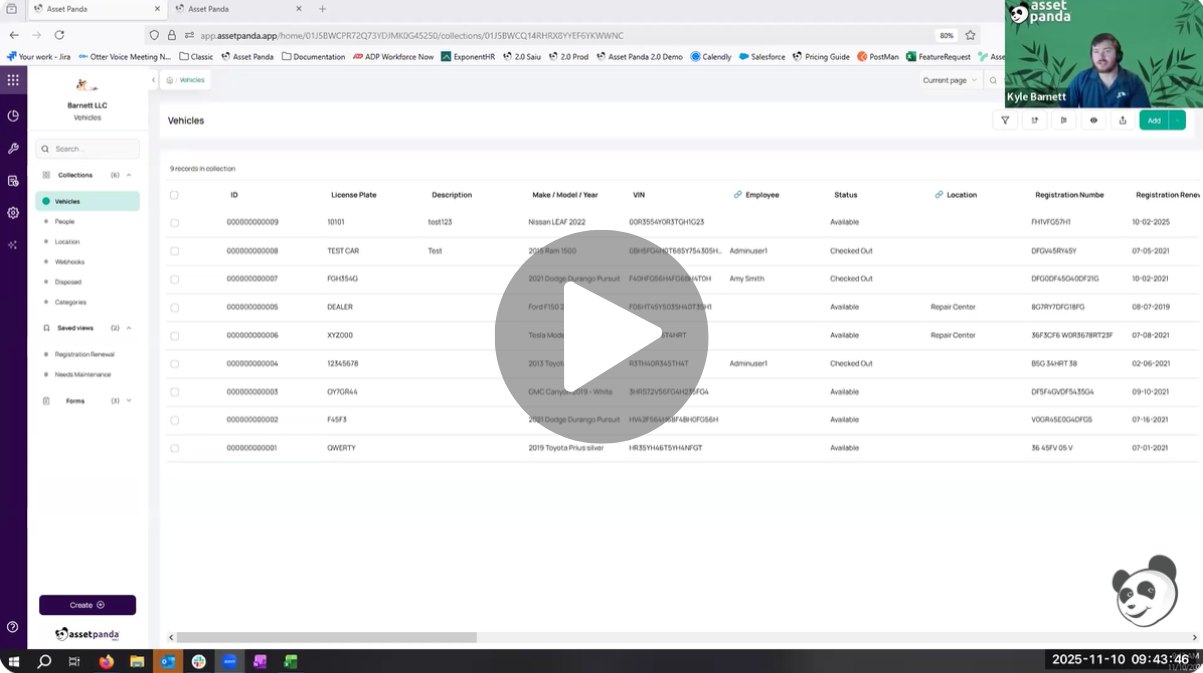

Watch a full tutorial of Asset Panda Pro’s depreciation functions in our YouTube video.

If you’re an existing customer looking to add depreciation functionality to your account, reach out to your Account Manager or [email protected].

Not yet a customer? Schedule a meeting with a solution specialist to see how Asset Panda Pro can help you save time and boost compliance.

Take Control of Your Assets

A personalized demo is just one click away.

Related News & Press

Learn more from a solution specialist

Schedule a demo to find out how you can transform your workflows with Asset Panda Pro

Contact our team at (888) 928-6112