Ghost Assets: Why They Could Kill Your Business And How To Eliminate Them

White Paper

Get The White Paper

The Hidden Cost of Ghost Assets

Ghost assets are an invisible threat to your company’s bottom line. These are items that have been lost, stolen, or disposed of but still remain on your books as if they’re active assets. Left unchecked, ghost assets can inflate your insurance premiums and tax payments, skew your financial statements, and even create compliance risks. In short, what you don’t know (or track) can hurt your business.

How to Eliminate Them

Our free white paper explores why ghost assets are so dangerous to businesses and outlines proven strategies to purge them from your asset register for good. Inside, you’ll learn how to:

- Implement robust asset management practices to keep every asset accounted for.

- Identify and remove “ghost” assets before they drain your budget and resources.

- Maintain an accurate asset ledger for clearer financial reporting and audits.

- Reduce unnecessary costs and risks by keeping your asset records up-to-date and error-free.

Don’t let ghost assets haunt your business any longer — download the free white paper now and safeguard your bottom line.

Learn more from a solution specialist

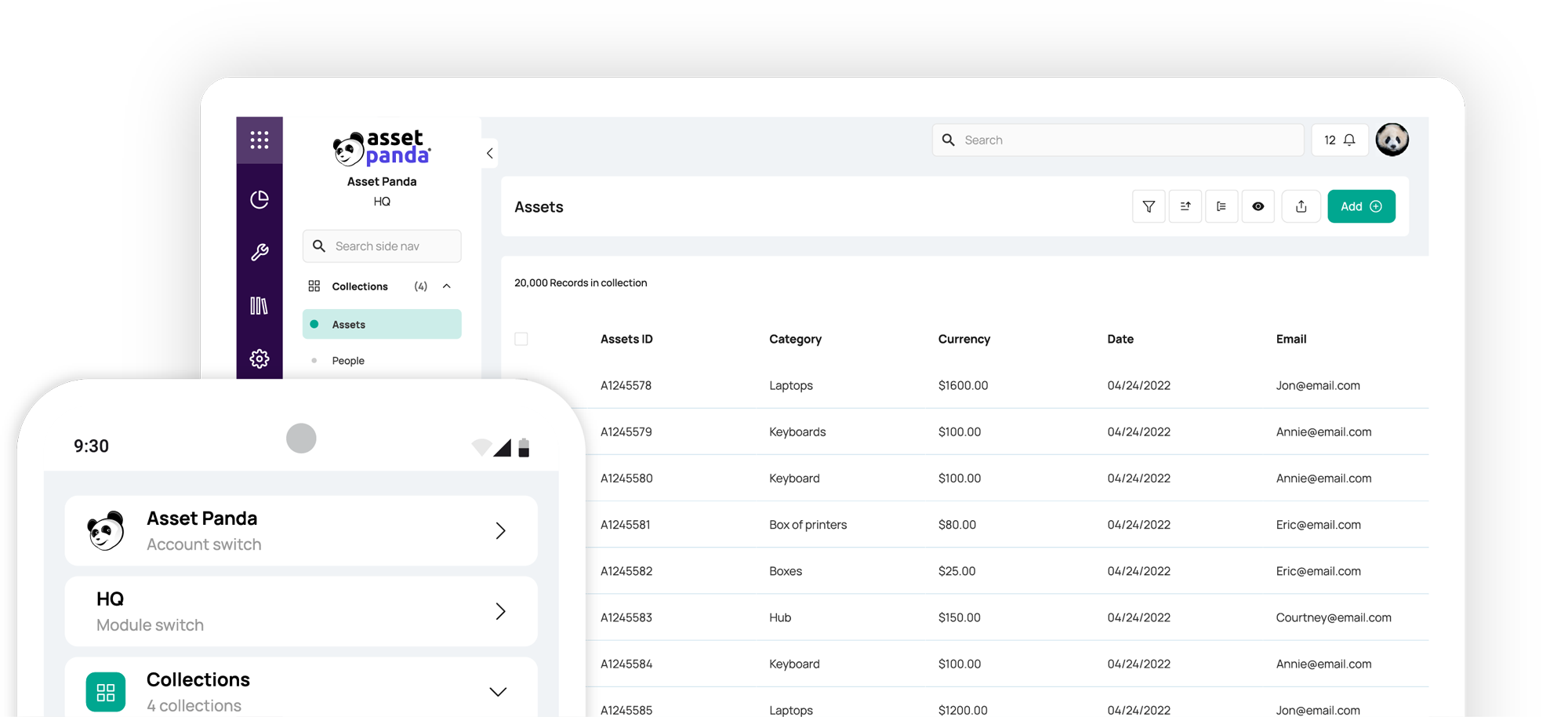

Schedule a demo to find out how you can transform your workflows with Asset Panda Pro

Contact our team at (888) 928-6112