How to Audit Fixed Assets: The Basics

For any organization, no matter the size or industry, knowing how to audit fixed assets can help reduce duplication and waste, theft and loss; track depreciation accurately; and eliminate fraud, among other benefits.

The Benefits of an Asset Audit

Knowing how to audit fixed assets and routinely conducting those audits helps confirm the following:

- The physical existence of the asset

- Asset classification

- Location of the asset

- Date of the asset purchase

- The original cost of the asset

- The proper labeling of the asset with its assigned asset barcode/ID number

- That the asset is in good working condition

- Quantities of each fixed asset

- Controls to prevent unauthorized access to fixed assets

- If revalued, details of revaluation

- Rate of depreciation

- Accumulated depreciation

- Depreciation for the current year

- Particulars about scrap or sale

- Overall asset control

Getting Started With an Asset Audit

So how do you get started? In an article for Chron.com, Patrick Gleeson, Ph.D., states that "the most basic of all fixed asset audit procedures is establishing that the asset exists … [and] "once the asset's existence is verified, its current value needs to be established, according to Generally Accepted Accounting Procedures (GAAP), beginning with a determination of acquisition costs, including invoice cost, verified freight costs and any taxes paid – most often, state sales taxes – and any other costs, such as set-up costs." When any fixed asset is sold, Gleeson adds, its fair market de-acquisition price should be established and recorded in the company's records.

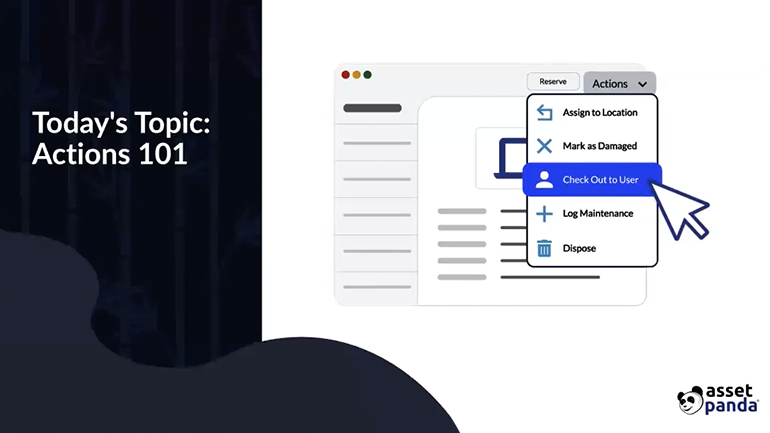

Fixed asset audits can be stressful, but having a fixed asset management software platform in place can make the process run far more smoothly. A fixed asset tracking platform centralizes all of your fixed asset data in a centralized, easy-to-access location, so there's no more wasted time hunting down asset locations and records. The platform also can simplify asset depreciation and ensure that the figures you provide your accounting team are accurate.

The Mobile Advantage

Even better is a mobile app that resolves the question of how to audit fixed assets and makes the process easy. No matter your line of work, your business can't be limited to what you can do behind a desktop computer. You often need access to asset data on the go and at odd hours. A mobile app that syncs with the cloud not only gives you the ability to conduct audits and access your information anytime, anywhere; it gives you the peace of mind that comes from knowing your data is both accurate and up to the minute. That means your depreciation figures aren't based on guesswork but on facts.

Not only do you have the ability to run audits from your mobile app, but you can also check on the maintenance history of any item, create customized reminders for routine preventive maintenance, create customized reports, and establish custom security settings based on such parameters as location.

Asset Panda's Asset Management Software to Streamline the Audit of Fixed Assets

With Asset Panda's best-in-class mobile app, the question of how to audit fixed assets is easy. Our mobile audit tool simplifies this complex process, completes your audit faster, and gives you the real-time data you need to make corrections and keep your business running efficiently and cost-effectively. And you won't need additional hardware to use Asset Panda – just the smartphones you and your employees already carry.

Learn why Asset Panda is one of the highest-rated asset management and auditing software by getting your free 14-day trial (no credit card required)!

Related News & Press

Learn more from an Asset Panda expert

Get a FREE consultation with an asset tracking expert to find out how you can transform your asset tracking.

Contact our Sales Team at (888) 928-6112