Depreciation of IT Assets: Methods and Useful Tips

Blog

Table of Contents

Take Control of Your Assets

A personalized demo is just one click away.

Which is more valuable: a used five-year-old laptop or a brand new one? If you can easily respond that the new laptop is worth more, congratulations: you already understand the basics of depreciation. Depreciation is the process by which assets lose value over time due to wear and tear or obsolescence. That’s why the depreciation of IT assets is a critical factor in managing them for any organization. Keeping track of IT asset depreciation helps your organization optimize its budgets, stay tax-compliant, and improve the accuracy of its overall asset tracking.

Read on to learn about which IT assets depreciate, methods for calculating their depreciation, and how to choose which method is right for you.

Key takeaways

- IT Asset Depreciation is the process by which IT assets lose their value over time.

- IT assets subject to depreciation include computers, servers, and off-the-shelf software.

- Factors to consider when calculating the depreciation of IT assets include initial cost, useful life, salvage value, and the method of depreciation used.

- The five methods of depreciation are straight line, double declining balance, sum-of-years-digits (SYD), units of production, and modified accelerated cost recovery system (MACRS).

Which IT Assets Depreciate?

From hardware to software and even AI data sets, your organization is holding on to a variety of types of technology that aid in its processes from day to day. However, not all of these IT assets depreciate. Let’s review what IT assets are and consider where the depreciation of IT assets does and does not apply.

Fixed IT Assets

Fixed assets are illiquid assets that remain in use for more than one accounting period (typically a year) and provide long-term revenue benefits. Examples of fixed IT assets include desktop computers, laptops, servers, printers, networking equipment, and datacenter infrastructure—all tangible hardware assets that aren’t subject to quick turnover. All fixed IT assets are subject to depreciation.

Current IT Assets

Current assets include liquid assets that an organization holds onto for a short period of time with the intent to use them up quickly. In the IT department, you’ll find current IT assets in the form of consumable supplies (like printer cartridges), short-term IT investments (like leased hardware), and cash that has been allocated for IT projects. None of these current IT assets are subject to depreciation.

Intangible IT Assets

What about intangible IT assets like software and licenses, that can’t be subjected to wear and tear? Despite its intangible form, some software counts as a fixed asset. If the software is used for more than one accounting period, used as a resource (rather than as inventory), and has not been altered into proprietary software specific to your organization alone, then it is subject to depreciation.

Factors Affecting IT Asset Depreciation

Once you’ve identified which IT assets depreciate, it’s time to begin tracking them. But before you choose a depreciation method, here are several factors to consider concerning the depreciation of IT assets.

Initial Cost

This refers not only to the amount of money it cost to acquire an IT asset, but also how much of an investment it took to introduce the asset into your organization, including deployment, configuration, and employee training costs.

Useful Life

Is this IT asset expected to last for a few years, or close to a decade? Assets that become obsolete quickly benefit from accelerated methods of calculating depreciation. It’s also helpful to have asset tracking data on similar assets in your organization to determine an average expected lifetime.

Salvage Value

Just because an IT asset is no longer useful to your organization doesn’t mean it has no value. If an asset can be sold as scrap at the end of its useful life, you can still recoup some of its cost. Keep in mind that for IT assets, which become obsolete due to technology advancement, salvage value is usually low.

Depreciation Method

The method you choose to calculate depreciation also plays a role in how quickly you can recover the initial cost of an IT asset.

Choosing an IT Asset Depreciation Method

There are five main types of depreciation you can use for IT assets.

1. Straight line depreciation

This is the most common depreciation method, which spreads an asset’s depreciation evenly across its useful life. It works well for calculating the depreciation of assets that experience consistent wear and tear overtime, like computers and laptops.

2. Double declining balance depreciation

This is an accelerated method that allows a business to write off the cost of an asset more quickly in the early years of its useful life. It is a good fit for IT assets that become obsolete quickly, like smartphones and digital cameras.

3. Sum-of-years-digits depreciation

This is another type of accelerated method, in which an asset is allotted a higher percentage of its depreciation in its early years. It can be used for assets that require less maintenance early on and more as they progress through their useful lives, like servers and network devices.

4. Units of production depreciation

This method accounts not for the years an asset is put into use, but for its actual productivity in the form of the number of units it produces. An example of an IT asset that could benefit from this method is IT-controlled manufacturing or factory equipment.

5. Modified accelerated cost recovery system (MACRS) depreciation

You could use MACRS, the standard method for tax depreciation in the U.S., for any type of IT asset.

Managing IT Asset Depreciation

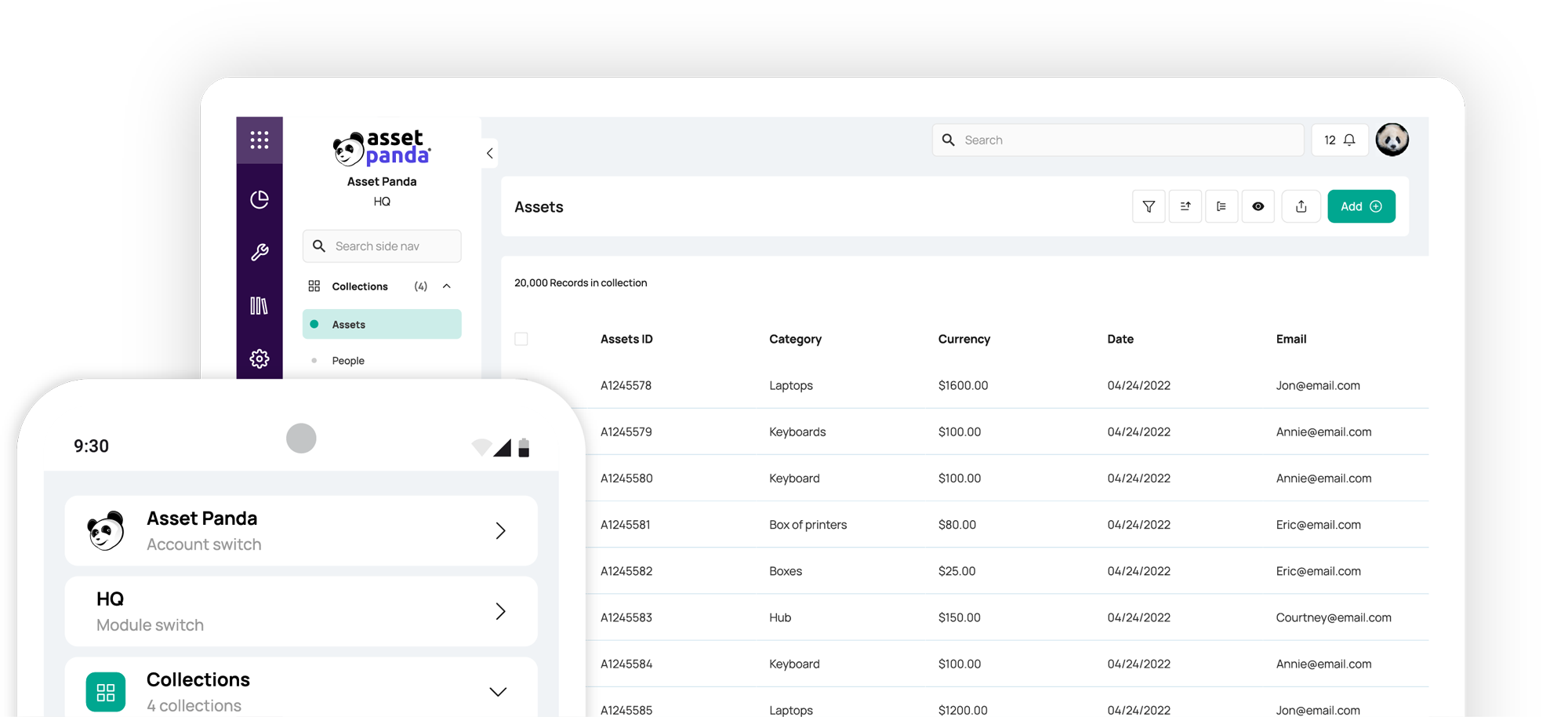

Ready to start managing the depreciation of your IT assets, but not sure where to begin? The best place to start is with an IT asset management software that automates this process. Asset Panda handles every step of tracking your IT assets from initial purchase to disposition, including calculating their depreciation with your chosen method automatically, so you don’t have to.

As your IT assets depreciate, Asset Panda follows them through each step of their lifecycle to ensure that you have the most accurate data on their usage so you can schedule routine maintenance before they show signs of wear and tear. And as your assets continue their useful lives, Asset Panda helps you make smart purchasing decisions for their eventual replacements by generating custom analytics about their usage, value generation, and repair costs over time.

Depreciation is a fact of life, but managing it doesn’t have to be a chore. By automating your depreciation calculations, you can improve your IT department’s efficiency and save money on your taxes in the background, while you and your team focus on the work that is most important to your organization’s bottom line.

Take Control of Your Assets

A personalized demo is just one click away.

[addtoany]

Frequently Asked Questions

Why is it important to depreciate IT assets?

It is important to calculate and manage the rate at which IT assets depreciate to recoup their upfront costs over the course of their useful lives.

An organization that adheres to a depreciation schedule is not taxed at a disproportionately high yearly rate for an asset that is declining in value year by year.

Is computer equipment 5- or 7-year depreciation?

Standard computer equipment, like laptops and desktop computers, have a five-year depreciation period. The chairs and desks people sit at while using those computers have a seven-year depreciation period.

What is the depreciation rate for software assets?

According to the IRS, proprietary software assets are not scheduled to depreciation schedule at all. However, unmodified off-the-shelf software has a three-year depreciation period.

Key factors influencing read distance include the scanner's technology (e.g., 1D laser, 2D imager, or RFID), the size and quality of the code or tag, and the environment.

Do computers follow a 60% or 40% depreciation?

Under the Income Tax Act, computers, laptops, and printers are considered to be Plant and Machinery assets for tax purposes, which means they are subject to a 40% depreciation rate.

What is section 179 for IT assets?

Section 179 of the US Internal Revenue Code allows businesses to write off the full cost of some IT assets in the same year they are put into use. Qualifying assets include hardware that has been purchased new and “off the shelf” software, making multi-year depreciation optional in these cases.

Learn more from a solution specialist

Schedule a demo to find out how you can transform your workflows with Asset Panda Pro

Contact our team at (888) 928-6112