How to Audit Fixed Assets: A Step-by-Step Guide

Blog

Table of Contents

Take Control of Your Assets

A personalized demo is just one click away.

Knowing how to audit fixed assets is an essential skill for any organization, regardless of its industry or size. From an accounting standpoint, an annual asset audit might be an organization’s most critical practice for maintaining its investments and preventing unexpected costs.

By the most basic definition, a fixed asset audit is the process of taking stock of a company’s non-current assets; that is, any investments or materials that a company requires for its day-to-day operations. Fixed assets consist of equipment and materials that an organization has purchased with the intent of long-term use. These are usually tangible items like furniture and computer equipment, but in some cases fixed assets can include intangible items like computer software. In accounting parlance, the opposite of a fixed asset is a current asset, defined as an asset that the organization maintains mainly for sale or resale.

Generally, a fixed asset audit should be performed at least once a year in order for an organization to keep its records accurate and up-to-date. This comprehensive guide will outline the importance of performing a fixed audit asset and the simplest way to conduct one.

The Benefits of A Fixed Asset Audit

At first glance, a fixed asset audit may appear to be an overwhelming task. Doing it right means taking stock of all of a company’s maintained investments, whether they be buildings and land, vehicles and machinery, software and computers, or all of the above. However, the benefits of learning how to audit fixed assets far outweigh the effort, and contain the following advantages:

- Keeping assets organized: Until you perform a fixed asset audit, you may not be aware of the breadth of an organization’s investments, where they are kept, or what they are used for. Auditing your asset helps keep your inventory orderly, secure, and accessible.

- Eliminating duplication and excess: Do you know how many computers your organization has? More importantly, do you know if that is the same amount of computers that your organization requires? Only an audit can show you if you are investing in more than you need. Before putting down cash to purchase a new asset, an audit can help you identify underutilized assets already in your possession.

- Recovering lost assets: Tracking fixed assets will minimize displacement. If a company asset is reported as lost, a fixed asset audit can serve as a record of that asset’s last recorded physical location, making it easier for an organization to track it down and recover it for further use.

- Preventing surprise costs: As assets age, they’ll likely depreciate in value or require repairs. By practicing an annual fixed asset audit, your organization won’t just know the current status of its assets but also be able to prepare for repairs and eventual replacements.

- Practicing compliance: If an organization doesn’t conduct annual asset audits, a regulatory or government agency may step in to do one instead. Prevent this scenario by keeping transparent, responsible records of your organization’s fixed assets independently.

Getting Started

Since the goal of an audit is to take stock of all the items your organization has invested in, the most crucial part of learning how to audit fixed assets is confirming that the assets actually exist.

The first step is to begin listing the location of all your assets as you audit them. To make your audit records as possible, the auditor should also record the asset’s appearance, condition, purchase date, original cost, and potential rate of depreciation. You can guess that this might be a challenge with a pen and paper, or even an Excel spreadsheet.

In order to make a fixed asset audit go as smoothly as possible, consider selecting a fixed asset tracking software platform with audit capabilities. With all your asset records and your audit tool in one centralized platform, it’s easy to build custom audit checklists and automatically update records based on any changes found in an audit. Additionally, software with a companion mobile app enables you to travel to different floors or buildings during an audit without carrying around a laptop, and empowers you to quickly audit items with a single scan if equipped with built-in barcode technology.

To ensure the most accurate fixed asset audit with the least amount of stress, consider using a robust audit tool like Asset Panda. Keep reading for a step-by-step procedure on how to perform a fixed asset audit with Asset Panda’s intuitive solution.

Step-by-Step: Performing An Asset Audit With Asset Panda

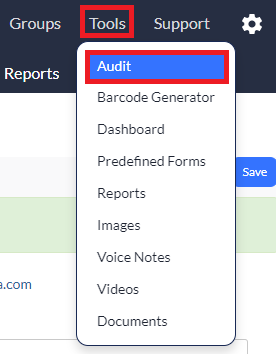

- To begin setting up your first audit, you’ll go to the upper right-hand menu and select “Tools” and then “Audit”.

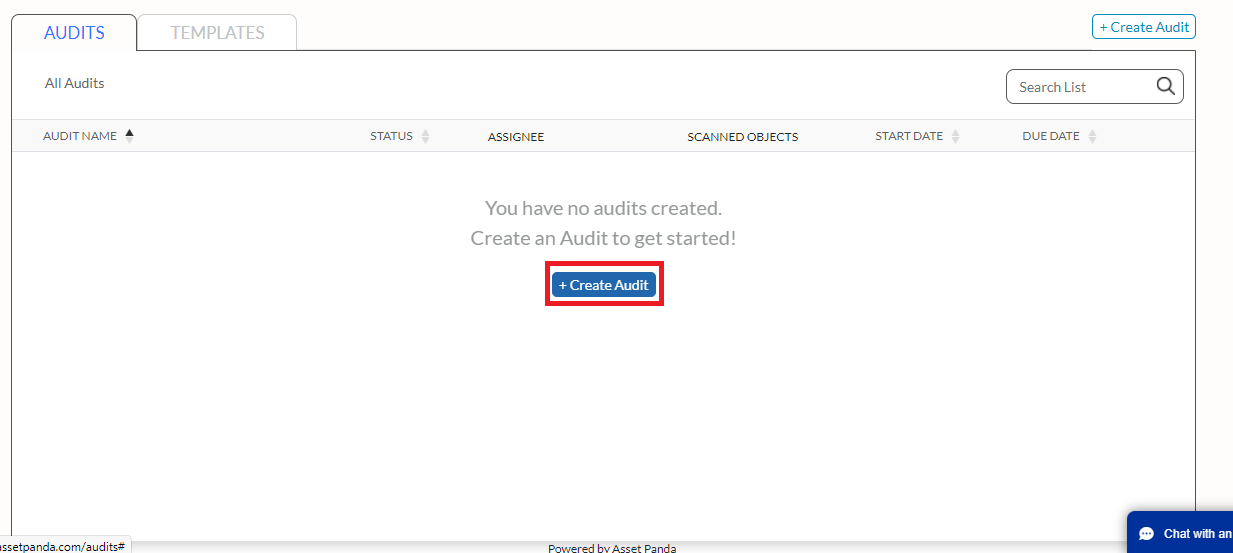

- Once you’ve landed on the Audit page, you’ll see any existing audits or templates listed on your screen. For the sake of this example, we’re going to build our first audit using the “Create Audit” button.

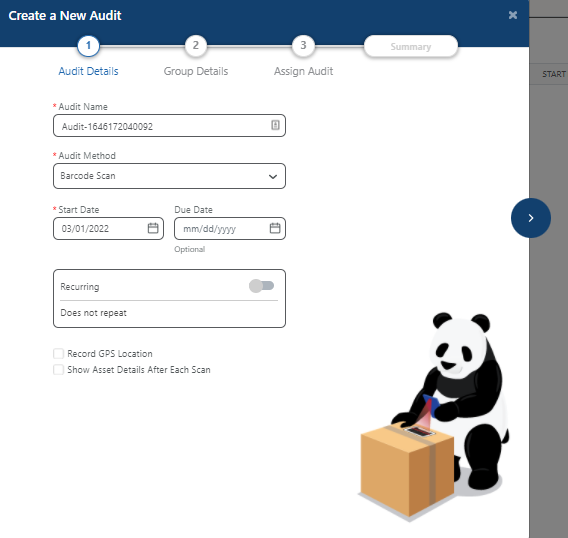

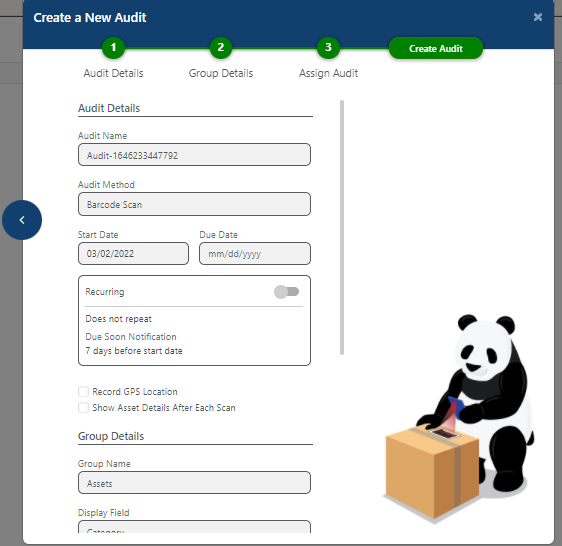

- As the first step to actually building your audit, you’ll want to name it, select the audit method (barcode scanning is a fast and simple to conduct audits right from the Asset Panda mobile app), and relevant dates. Here you can also set audits as recurring and opt to record their GPS location at the time of the audit.

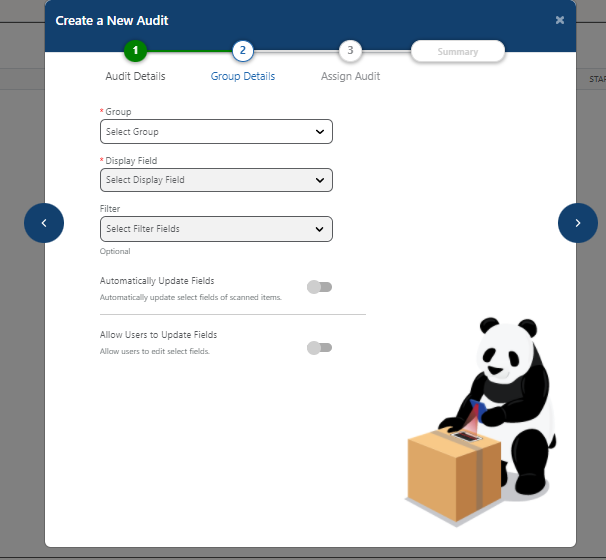

- While Asset Panda audits are highly configurable, each audit you build needs to be associated with a specific asset group (e.g., IT assets, furniture, or tools). You’ll select the Display Field, such as asset name or serial number, to help your assignee know which asset they’re looking for. You can also select whether you want asset records to automatically update based on the audit result.

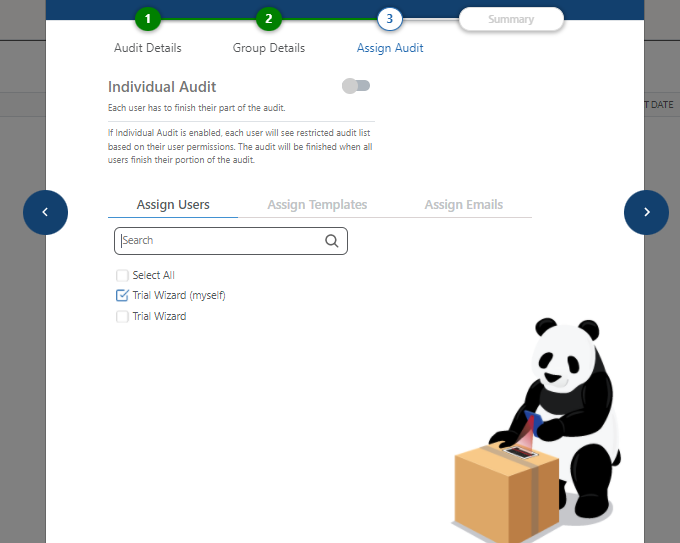

- Next, you’re ready to assign your audit. You can choose to assign an audit to specific users with Asset Panda, user templates (e.g., administrators or power users), or specific email addresses.

- After you’ve completed the 3 core steps of the audit configuration process, you’ll move on to a summary page where you can confirm all your audit details. Finally, select “Create Audit” to officially publish and assign it!

Audit Your Fixed Assets Seamlessly

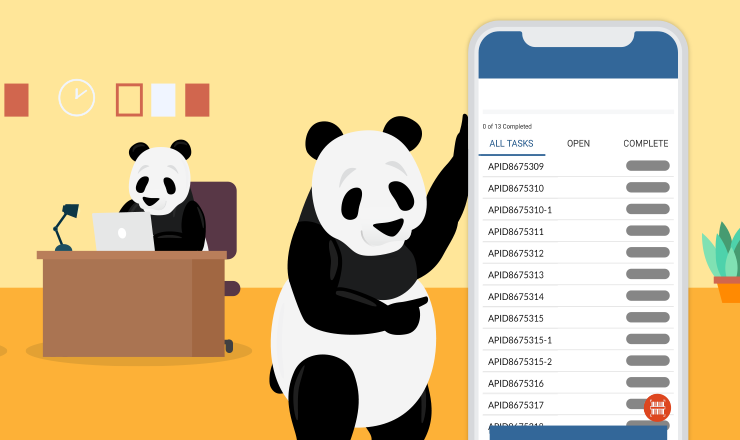

Whether you’ve performed a fixed asset audit in the past or you’re starting from scratch, Asset Panda meets you where you are with features to import existing assets or tag brand ones into your system. Our easy to use app lets you hit the ground running on this critical process with minimal setup.

A fixed asset audit that fully encompasses your entire organization and its inventory may sound like an intimidating task, but Asset Panda's best-in-class software simplifies what could otherwise be a daunting process. Our mobile audit tool helps you complete your audit faster with built-in barcode technology, and gives you the real-time data you need to make corrections and keep your business running efficiently and cost-effectively.

See for yourself why Asset Panda is one of the highest-rated asset management and auditing software–request your personalized demo today!

Take Control of Your Assets

A personalized demo is just one click away.

[addtoany]

Related News & Press

Learn more from a solution specialist

Schedule a demo to find out how you can transform your workflows with Asset Panda Pro

Contact our team at (888) 928-6112