Which Assets Cannot Be Depreciated? Examples & Exemptions

Blog

Table of Contents

Take Control of Your Assets

A personalized demo is just one click away.

Depreciation is an accounting method that lets organizations gradually write off the upfront cost of an asset over the course of that asset’s useful life. It’s a standard procedure for recovering an item’s value while understanding that any fixed asset—from computer software to a delivery truck—won’t last forever and will eventually need to be replaced. That said, depreciation is not a one-size-fits-all method, and most organizations possess several common non depreciated assets that don’t qualify. So, which assets cannot be depreciated and how should you manage them?

What Are Non-Depreciated Assets?

To determine which assets cannot be depreciated, it’s important to first understand what can be depreciated. According to the IRS, a depreciable asset must be owned by you or your business and used strictly for business (as opposed to personal use). However, there are several exceptions to this rule.

First is if the asset is mixed-use. If you own an asset for both business and personal use, you may only depreciate the portion of the asset that you use for business. For example, if you use a car for both business and personal reasons, you can only depreciate the vehicle’s value based on the mileage and wear and tear put on it during business use.

The second and more rare exception concerns rented or leased assets. If you do not own an asset but you make capital improvements to it, you may depreciate that asset. For example, if your business rents an office rather than owning it outright and renovates that office space, you may depreciate that cost.

Examples of Non-Depreciated Assets

Beyond these exceptions to the rule, the IRS provides several clear-cut examples regarding which assets cannot be depreciated. Here is a list of examples:

- Land.

- Investments and other intangible assets. This could refer to stocks, bonds, franchises, goodwill, or agreements not to compete.

- Collectibles, such as coins, cards, and similar memorabilia.

- Personal property, including your home and car.

- Short-term assets, meaning they were purchased and used or sold off in the same year.

Notice that non-depreciated assets can include both fixed assets, like land, and current assets, like investments. While current or intangible assets are often thought to be the only assets that do not depreciate, it’s important to keep these specific examples in mind for accounting accuracy.

Why Can’t You Depreciate These Assets?

While depreciable assets gradually lose value over their lifespan as they are regularly used to support business operations, non-depreciated assets are expected to gain or lose value according to market conditions and economic factors. Personal property, however, is the exception to this rule, as you aren’t using it to produce income in the first place. Depreciation is strictly a cost-saving measure available to organizations regarding long-term assets they use to improve their bottom lines, and which experience wear and tear during that process.

For example, if your organization owns its office building, that building will eventually require repairs. It might need new furnishings, renovations, or updates. All of these expenses are depreciable. However, if your organization also owns the land where the building is located, that property is exempt from depreciation. Land values vary but typically appreciate based on outside factors that have nothing to do with your organization’s daily use. Keep in mind, however, that if you do make improvements to the land, you can still deduct that as a business expense.

Why You Should Audit Depreciated and Non Depreciated Assets

Non-depreciated assets fill an important role in any organization’s finances. Their ability to contribute to powerful growth over time without experiencing any wear and tear is their biggest advantage. That’s why it isn’t a bad thing for your company to own assets that cannot be depreciated.

Even though you can’t depreciate the assets listed above, it’s still vital to your organization’s bottom line to keep track of them in an organized fashion. The best way to get started is to perform an asset audit. The benefits of an asset audit mean you’ll be able to readily locate assets, minimize loss, prevent surprise costs, and keep well in compliance with transparent accounting records.

If you’re just getting started with fixed asset audits, consider recording information like the locations, status, and use cases of your organization’s physical assets. Once you create an internal audit process that makes sense for your company, it’s advisable to perform a fixed asset audit once every accounting period (or about once a year) to maintain accurate asset records.

Track and Audit Your Assets with Asset Panda

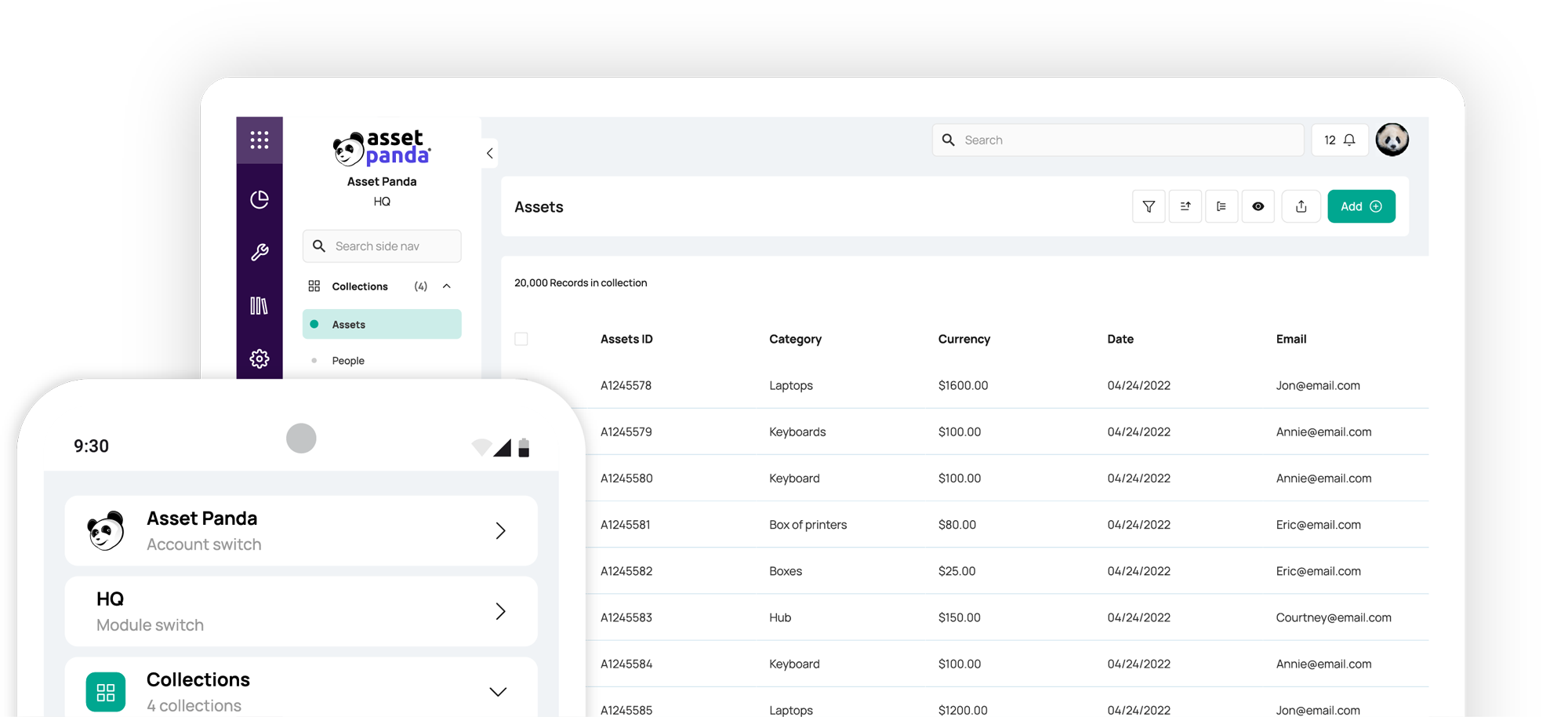

Many organizations possess hundreds or even thousands of fixed assets, both depreciated and non-depreciated alike. When you’re working with that level of scale, a standard Excel spreadsheet isn’t going to cut it. But with a comprehensive platform like Asset Panda, your organization can keep track of all your fixed and current assets in one place.

Asset Panda’s robust software not only helps you maintain real-time visibility into all your assets but also automatically calculates depreciation for the right assets. Our highly customizable solution allows you to track every kind of asset from physical to intangible. When it comes time to audit your inventory, you can easily build separate audits for your depreciated and non depreciated assets and assign them to employees on a set schedule. Using our mobile app with built-in barcode technology, your team can quickly perform audits by scanning their unique barcodes.

From independent businesses to companies as large as Amazon and Toyota, thousands of organizations trust Asset Panda to provide custom solutions to keep track of the assets they depend on every day. With Asset Panda, you can access all the information about your organization’s assets in one central hub on your computer or on your mobile device.

Discover how Asset Panda can meet your organization’s unique needs and request your personalized demo today.

Take Control of Your Assets

A personalized demo is just one click away.

[addtoany]

Related News & Press

Learn more from a solution specialist

Schedule a demo to find out how you can transform your workflows with Asset Panda Pro

Contact our team at (888) 928-6112