How to Account for Camera and Photography Equipment Depreciation Life

Blog

Table of Contents

Take Control of Your Assets

A personalized demo is just one click away.

No matter how well you take care of your cameras, lenses, lighting equipment, tripods, and more, your photography equipment will depreciate in value over time. To ensure your equipment stays in working order, it’s essential to calculate camera depreciation life. In this article, we’ll discuss the ins and outs of photography equipment depreciation and the various methods to calculate it.

What is Your Camera’s Useful Depreciation Life?

Camera depreciation life refers to the period of years over which your camera is depreciated for accounting and tax purposes. The useful life is essentially how long the IRS (or your business accounting policy) expects the asset to last and provide value. For professional cameras and major equipment, a five-year useful life is commonly used under U.S. tax rules.

Why five years? The IRS publishes asset class lives for depreciation, and while photographic equipment isn’t explicitly listed in its own category, it’s generally accepted to depreciate high-tech gear like cameras over five years in line with similar equipment. This reflects that cameras and electronic devices tend to lose value relatively quickly as technology advances. By year five, a camera is often near the end of its productive life for a pro (or at least significantly outdated in features).

It’s worth noting that useful life for taxes can be somewhat standardized, but actual usage can differ. Some sturdy equipment might physically last longer than five years – for example, a quality lens or a heavy-duty tripod could be useful for 7-10 years if well maintained. Conversely, a camera body used daily by a busy studio might be ready for replacement after 3-4 years due to shutter wear or new technology. Always consult a tax professional if unsure, but five years is a safe rule of thumb for camera gear depreciation life.

How to Calculate Camera Depreciation

Once you know the useful life of your camera or other equipment, how do you calculate annual depreciation? There are a few common methods photographers use to depreciate their cameras–here’s a quick overview of each. For an in-depth guide, please refer to our post: How to Calculate Depreciation for Assets.

1. Straight-Line Depreciation

Straight-line depreciation is the most common method of depreciation, and it’s the easiest way to depreciate photography equipment. It works by taking the following steps:

- Determine the original cost of the item.

- Determine the asset’s salvage value (aka what the item will be worth at the end of its useful life).

- Subtract the salvage value from the initial cost.

- Divide the asset value by the years of useful life you expect to get from the asset (in the case of this blog post, we’ll use five years).

For example, if the original purchase price of a camera is $3,500 and it has a $1,000 salvage value, its depreciable amount is $2,500. With a five-year useful life, the camera will depreciate by $500 each year until it reaches its salvage value.

2. Double Declining Depreciation

Double declining depreciation is an accelerated version of depreciation. This form of depreciation is used when assets are most likely to see their usefulness play out during the first few years of their lifespan.

- Calculate the item’s straight-line depreciation rate.

- Multiply the straight-line rate by 2 to get the double declining rate.

- Apply the double declining rate to the asset’s remaining book value each year of its useful life.

Using the same camera as the example, its straight-line depreciation rate would be 20%, making the double declining rate 40%. In Year 1, you would multiply the book value of the camera, $3,500 by 40% for a depreciable amount of $1,400. Then, subtract the depreciable amount from the book value ($3,500 - $1,400) for a remaining book value of $2,100.

In Year 2, you’ll multiply the remaining book value, $2,100 by 40%, making the depreciable amount $840. Your new remaining book value would be $2,100 - $840 = $1,260.

3. Units of Production Depreciation

Another method sometimes mentioned is units of production, aka usage-based depreciation.

- Determine the total expected production or usage (e.g., shutter clicks).

- Subtract the asset’s salvage value from its cost to find the depreciable amount.

- Calculate depreciation per unit.

- Multiply by actual units produced for the period (e.g., one fiscal year).

Using the same $3,500 camera with a $1,000 salvage value, your depreciable amount would be $2,500. If the camera has an estimated 300,000 shutter clicks, the units of production depreciation rate would be $2,500 / 300,000 = $0.0083 per click. If the photographer goes through 60,000 shutter clicks in Year 1, the year’s depreciation expense would be 60,000 × 0.00833 = $499.80.

Is Photography Equipment Depreciable?

Yes – in fact, most professional photography equipment qualifies as depreciable property under IRS rules. The IRS allows you to depreciate “property used in a business” that has a useful life beyond one year. This means your cameras, lenses, tripods, lighting kits, and similar gear used for your business can be depreciated over time. In order for photography equipment to be depreciable, it must meet a few basic IRS criteria:

- You own the equipment.

You can only depreciate assets you own, not any leased or rented gear. - It is for business use.

The equipment must be used in your business or income-producing activity (personal hobby cameras don’t count for depreciation). - It has a useful life of more than one year.

Photography gear must have a determinable useful life of over one year to qualify for depreciation.

Fortunately, most gear fits these photography equipment depreciation requirements. High-value items you’ll use for several years – including cameras, lenses, lighting equipment, light stands or tripods, backdrops, and even computers and hard drives for editing – are all considered capital assets. Small accessories or supplies that have a useful life of less than one year (e.g., memory cards, batteries, inexpensive backdrops, etc.) are usually expensed outright as day-to-day business expenses.

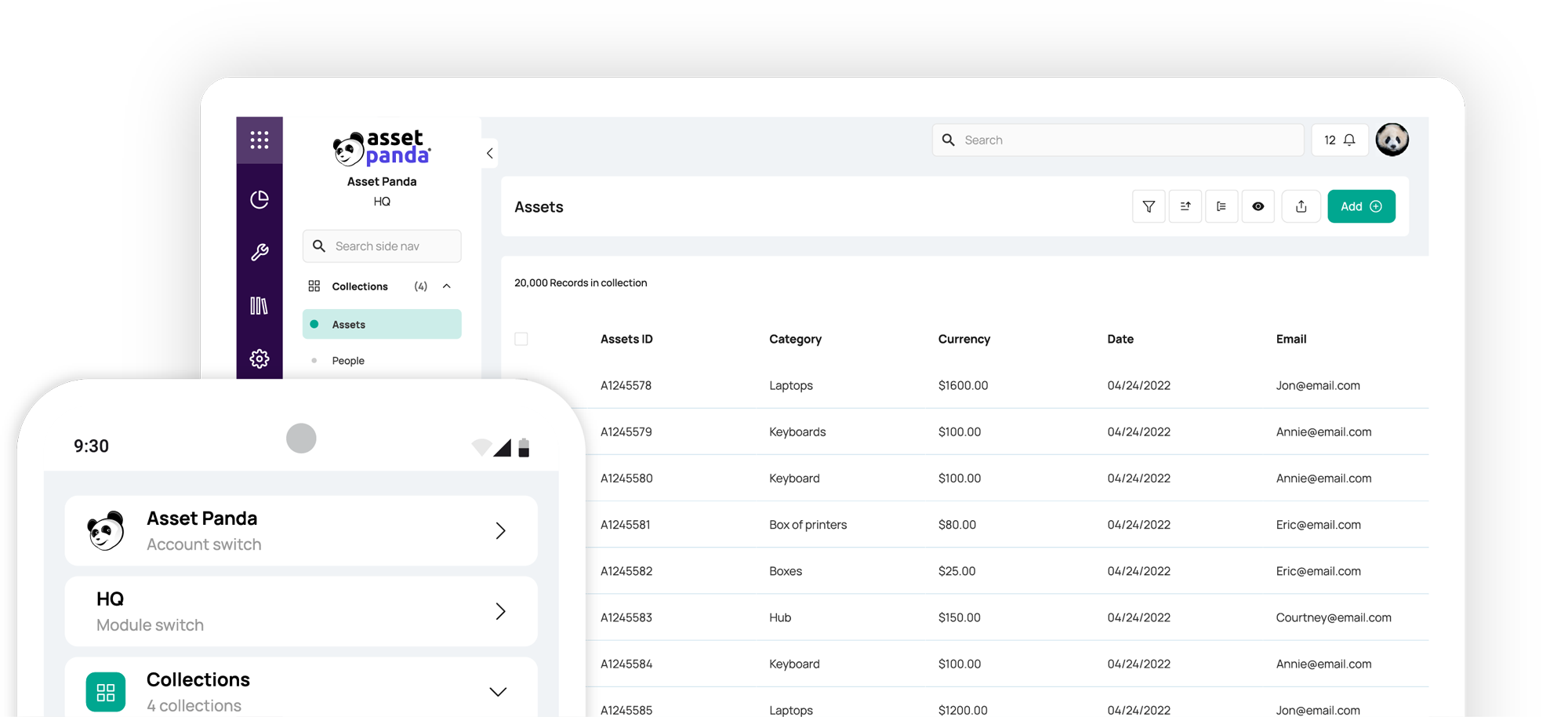

Seamlessly Track Depreciation with Asset Panda

Calculating photography equipment depreciation and keeping tabs on the useful life of each piece of gear can get complicated as your photography business grows. That’s why it’s essential to use one centralized fixed asset management platform to track all your asset details and their depreciation rates.

If you’re looking for a seamless solution to manage your photography equipment and track camera depreciation life, Asset Panda can help. From cameras to lights and everything in between, our highly flexible platform can track all your photography equipment in one convenient place. Asset Panda makes it easy to record each item’s original purchase value, salvage value, and useful life so you can automatically calculate depreciation using your desired method and schedule.

Ready to see how Asset Panda can help your photography business save time and streamline depreciation tracking? Schedule your personalized demo today.

Take Control of Your Assets

A personalized demo is just one click away.

[addtoany]

Related News & Press

Learn more from a solution specialist

Schedule a demo to find out how you can transform your workflows with Asset Panda Pro

Contact our team at (888) 928-6112