Current vs Fixed Assets: Differences, Examples and Importance

Blog

Table of Contents

Take Control of Your Assets

A personalized demo is just one click away.

For any business, large or small, managing assets is crucial to maintaining financial stability and ensuring smooth operations. Assets are categorized into current vs fixed assets, each serving distinct roles in a company’s financial ecosystem. While fixed assets vs current assets differ in their function and lifespan, both are essential for a business's success.

Understanding the differences between these asset types helps businesses with accurate financial reporting, strategic investment decisions, and effective resource allocation. This guide will explore current vs fixed assets, providing examples, key differences, and insights into why proper asset management is so important.

What Are Current Assets?

Current assets are short-term assets that businesses expect to convert into cash or consume within a year. These assets are essential for funding daily operations, managing working capital, and covering short-term liabilities. Since they contribute to liquidity, businesses must monitor them closely to maintain a healthy financial position.

Examples of Current Assets:

- Cash and cash equivalents. This refers to readily accessible financial resources, including physical currency, funds held in bank accounts, and short-term investments that can be swiftly converted into cash without significant loss of value.

- Accounts receivable. Money owed by customers for goods or services provided on credit. Businesses rely on timely collections to maintain cash flow.

- Inventory. Raw materials, partially completed products, and finished goods prepared for sale. Efficient inventory management helps maintain consistent production and minimizes storage expenses.

- Marketable securities. Short-term investments like stocks, bonds, and treasury bills that can be easily liquidated.

- Prepaid expenses. Payments made in advance for services such as rent, insurance, or subscriptions. These assets decrease over time as services are used.

Since current assets are expected to be used or converted into cash within a short period, businesses must track them regularly to avoid liquidity issues.

What Are Fixed Assets?

Fixed assets are long-term resources that businesses use for operational purposes over multiple years. Unlike current assets, fixed assets are not meant for immediate sale but rather for generating revenue and supporting business infrastructure. These assets typically require a substantial investment and are subject to depreciation over time.

Examples of Fixed Assets:

- Property and buildings. Office spaces, warehouses, retail stores, and other real estate holdings used for business operations.

- Machinery and equipment. Production equipment, manufacturing tools, and specialized machinery essential for business processes.

- Vehicles. Company-owned cars, trucks, and delivery vans used for transportation and logistics.

- Furniture and fixtures. Office furniture, shelving units, lighting, and other permanent fixtures in a business location.

- Land. Owned plots of land used for expansion, storage, or other business functions. Unlike other fixed assets, land does not depreciate over time, leading to the question of which assets cannot be depreciated. Land is a primary example since it does not wear out, unlike equipment or buildings that lose value over time.

Fixed assets are considered long-term investments and must be properly managed to ensure efficiency and compliance with financial regulations.

Key Differences Between Current and Fixed Assets

While both current vs fixed assets are crucial for financial health, they serve different purposes in business operations. Here’s how fixed assets vs current assets differ:

Liquidity

- Current assets can be quickly converted into cash within a year.

- Fixed assets are long-term investments and are not easily liquidated.

Usage Timeline

- Current assets are short-term resources used for daily operations.

- Fixed assets are held for years and contribute to long-term business growth.

Depreciation

- Current assets do not depreciate over time due to their short lifespan.

- Fixed assets depreciate, meaning they gradually decline in value over time due to regular use, aging, and technological advancements that may render them less efficient or outdated. This can lead some business owners to ask if accumulated depreciation is an asset. While accumulated depreciation appears on the balance sheet, it is considered a contra asset, meaning it reduces the book value of a fixed asset rather than being an asset itself.

Financial Reporting

- Current assets are recorded as short-term assets on the balance sheet.

- Fixed assets appear under long-term investments and require depreciation tracking.

Purpose

- Current assets support working capital and short-term operational needs.

- Fixed assets are used for production, service delivery, and infrastructure development.

These differences highlight why businesses need separate strategies for managing fixed assets vs current assets to maintain financial stability.

The Importance of Fixed Asset Management

Managing fixed assets effectively is key for long-term business success. Without proper tracking, companies risk losing valuable resources, overspending on maintenance, and failing to comply with financial regulations.

5 Key Reasons for Fixed Asset Management:

- Accurate financial reporting. Fixed assets must be accurately recorded on balance sheets to reflect a company's true financial position. Depreciation calculations impact tax deductions, and incorrect reporting can lead to compliance issues.

- Cost control and budgeting. A clear asset management strategy helps businesses plan for future investments, maintenance costs, and asset replacement schedules. Without proper oversight, companies may overspend or underutilize valuable resources.

- Maximizing asset utilization. Fixed assets should be maintained and used efficiently to ensure longevity and performance. A well-managed asset lifecycle prevents underutilized items and unnecessary replacements and enhances productivity.

- Reducing loss and theft risks. Tracking fixed assets minimizes the risk of loss, theft, or unauthorized usage. Businesses can easily associate assets with a specific location, assignee, and asset tags to enhance accountability and security across their systems.

- Enhancing business scalability. Proper asset management allows companies to scale their operations smoothly. By keeping track of asset conditions and planning for upgrades, businesses can expand without unnecessary delays or financial strain.

One essential tool for managing fixed assets is a fixed assets schedule, which helps businesses track depreciation, maintenance, and disposal over time. Without a structured approach to managing fixed assets, businesses may struggle with inefficiencies, financial inaccuracies, and wasted resources.

Manage Your Fixed Assets with Asset Panda

Knowing the difference between current vs fixed assets allows businesses to manage their finances more effectively. While current assets support short-term operations, fixed assets contribute to long-term success. Both play vital roles in ensuring business sustainability, and proper management is essential.

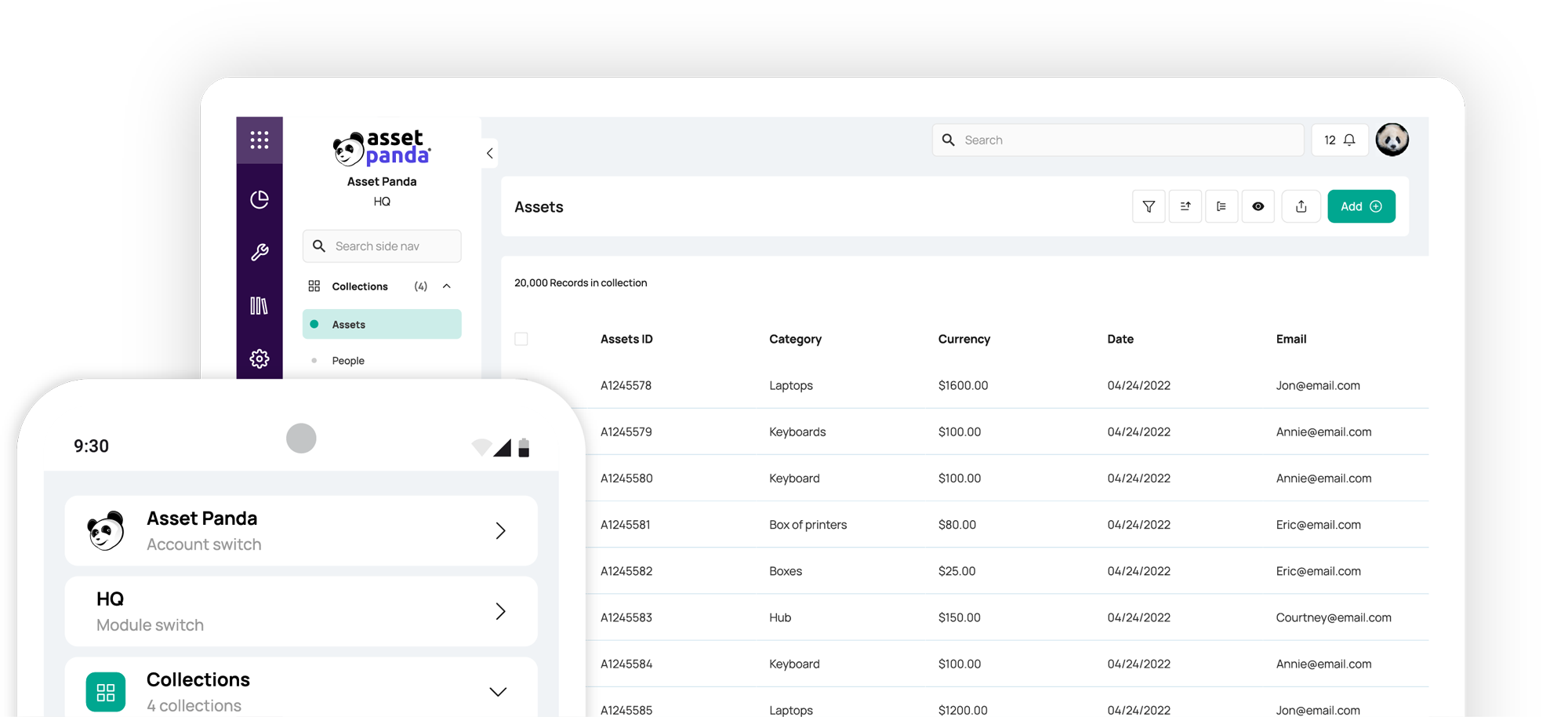

Proper asset management requires the right tools. Asset Panda provides businesses with a comprehensive asset tracking solution to manage fixed assets efficiently. Asset Panda simplifies asset management, ensuring businesses stay organized, compliant, and cost-effective.

With Asset Panda, businesses can:

- Track fixed assets in real-time for improved visibility.

- Automate depreciation calculations to streamline financial reporting.

- Schedule maintenance and repairs to maximize asset lifespan.

- Generate detailed reports for audits, tax filings, and compliance.

Asset Panda offers a powerful solution for tracking, maintaining, and optimizing fixed assets. Whether your business is managing property, equipment, or inventory, a structured asset management system can improve efficiency, reduce costs, and enhance overall financial performance.

Invest in better asset management with Asset Panda and take control of your business’s financial future. Request a demo today and learn how Asset Panda can help you manage your fixed assets, setting your business up for success.

Take Control of Your Assets

A personalized demo is just one click away.

Related News & Press

Learn more from a solution specialist

Schedule a demo to find out how you can transform your workflows with Asset Panda Pro

Contact our team at (888) 928-6112